Introduction

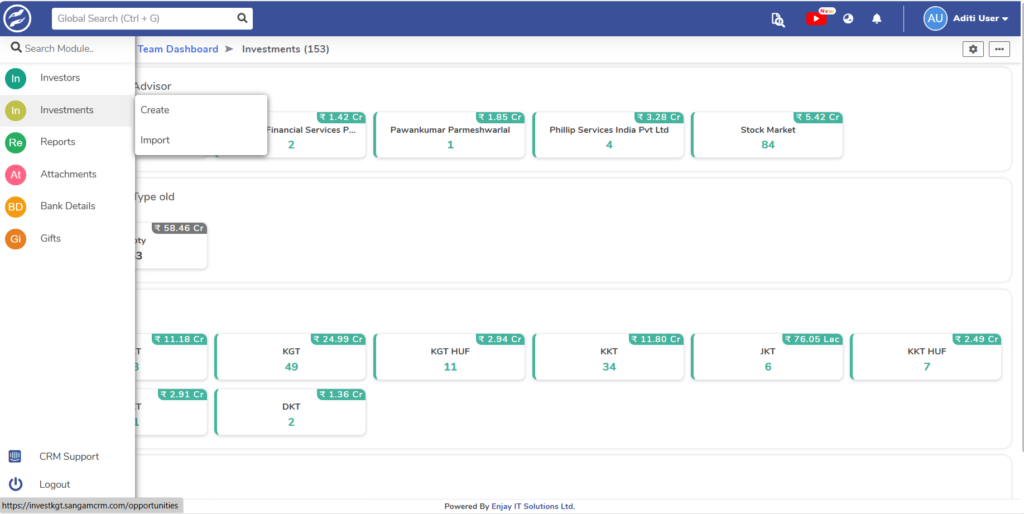

This project aims to develop a comprehensive Customer Relationship Management (CRM) system for Kirti Thakkar, designed specifically to streamline the tracking and management of investments. The CRM includes modules for managing investors, investment types, interest rates, bank details and generating detailed reports to enhance investment oversight and operational efficiency.

Project Overview:

The primary objective of this project was to create a specialized CRM system to manage and track investments for Kirti Thakkar. The system includes various modules tailored to handle investor information, investment categories, interest rates, bank details and reporting. By centralizing these functionalities, the CRM ensures a seamless and efficient process for managing investment-related data, generating reports and providing actionable insights.

Project Components

Modules and Features Implemented:

1.Contact Module to Investors Module:

All Investors and Bank Details: The contact module was customized to handle all investor-related information, including their associated bank details. This integration allows for all pertinent information to be accessible in a single location, making it easier to manage investor profiles and financial data.

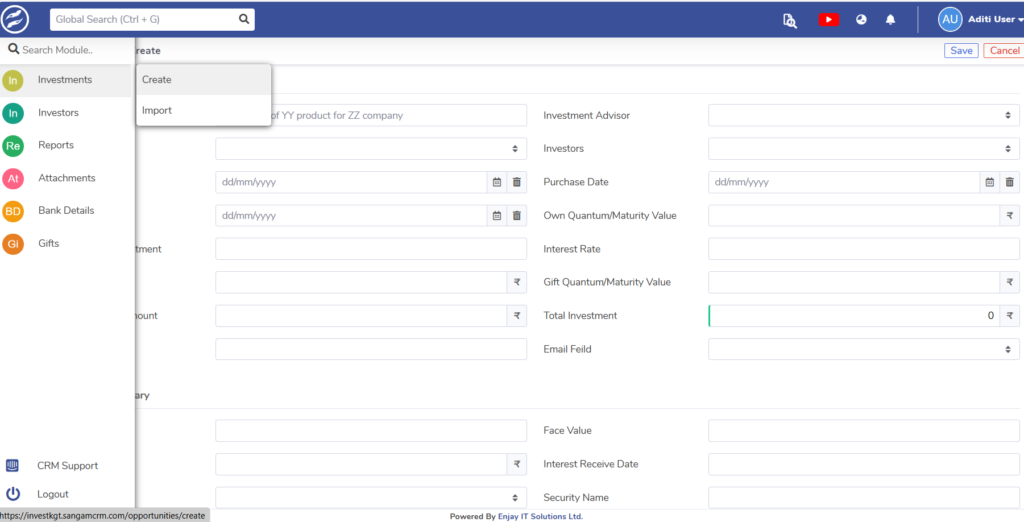

2.Opportunity Module to Investment Module:

Investment Type Dropdown: A dropdown menu was created to categorize various investment types, such as Tax-Free Bonds, 0% Coupon Bonds and Perpetual Bonds. Each selected investment type triggers the display of specific fields related to that particular type.

Investor Advisor Dropdown: An additional dropdown was added to select investor advisors, facilitating the management of advisor-investor relationships and ensuring proper tracking of advisory services.

3.Dynamic Fields Based on Investment Type:

Investment-Specific Fields: Depending on the investment type selected, relevant fields are displayed:

- Tax-Free Bond: Displays fields related to tax-free bond details.

- 0% Coupon Bond: Displays fields related to 0% coupon bond details.

- Perpetual Bond: Displays fields related to perpetual bond details.

4.Custom Fields for Investments:

Own Quantum and Maturity Value, Quantum/Maturity, Gift Quantum/Maturity Value: Custom fields were created to capture the quantum and maturity value of investments, including those that are gifted. If quantum/maturity gifts have been given, “no” will appear in the report, indicating no further action is required.

Interest Rate and Interest Rate Investment: Fields were added to capture the interest rate and investment details. If interest rate gifts have been given, “no” will appear in the report, similarly indicating no further action is required.

Interest Rate Calculation Formula: A formula was implemented to automatically calculate the interest rate when the quantum/maturity price and interest rate are entered, ensuring accurate data entry and reporting.

5.Ticket Module to Gift Module:

Tracking Investment Gifts: The ticket module was customized to track investment gifts provided to investors. A formula was applied to calculate and display the interest rate on the gifted amount, allowing for efficient management of gift-related investments.

6.Investment Name Related Field:

List of Investments: A related field was created to display a list of all investments when an investment name is selected, providing a quick overview of all relevant investment details.

7.Payment Details Module to Bank Details Module:

Customized Bank Details: The payment details module was transformed into a bank details module, specifically customized to capture and manage the bank information of investors.

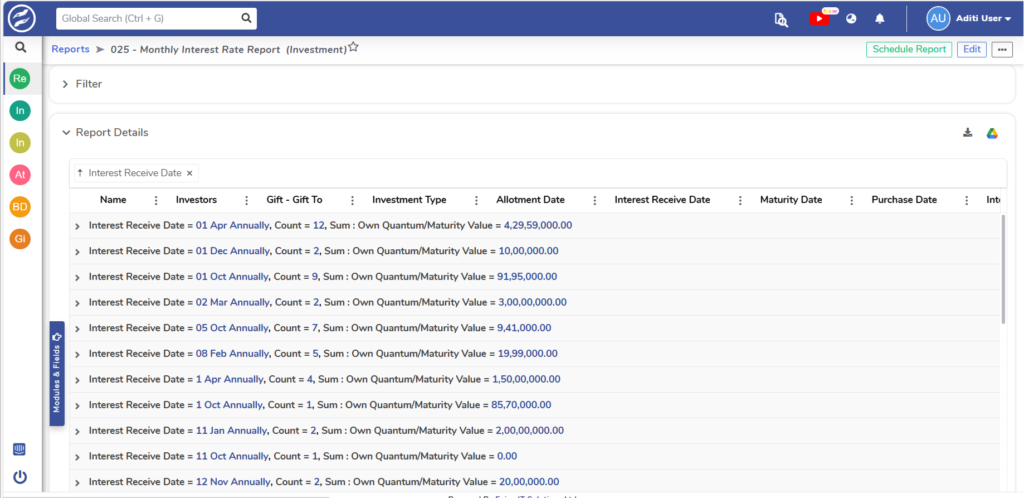

8.Report Module:

Investment Reports: A series of comprehensive reports were developed to cover various aspects of investments, including:

- All types of investment reports

- Individual investor investment reports

- Own investment reports

- Bond-wise reports

- Interest income reports

- Monthly interest reports

Kirti Thakkar in CRM Implementation

Implementation Process:

1.Requirement Gathering:

Detailed discussions were held with Kirti Thakkar to fully understand the specific requirements for investment tracking and reporting. These sessions helped define the necessary fields, modules, and workflows required to meet the business needs.

2.Module Customization:

The existing CRM modules were customized to incorporate new fields and functionalities tailored specifically to investment tracking. This customization ensured the system could efficiently handle all aspects of investment management.

3.Dropdowns and Dynamic Fields:

Dropdown menus and dynamic fields were implemented to ensure that only relevant information is displayed based on the selected investment type. This not only simplifies data entry but also improves the accuracy of the information captured.

5.Formula Implementation:

Formulas were applied to automate the calculation of interest rates and to ensure precise tracking of investment and gift details. This automation minimizes errors and enhances the reliability of the CRM data.

6.Report Development:

Comprehensive reports were developed to provide deep insights into various aspects of investments. These reports are designed to offer detailed, actionable information, enabling better decision-making and efficient management of investments.

Conclusion:

The customized CRM system for Kirti Thakkar has successfully streamlined the investment tracking process, provided robust reporting capabilities and ensured efficient management of investor and investment information. By centralizing all investment-related data and automating key processes, the CRM has enhanced decision-making and optimized the overall investment management process. The system’s tailored features and comprehensive reporting ensure that Kirti Thakkar can manage investments with greater accuracy, efficiency and insight.